QuickBooks Auto Payroll

Designing a more flexible payroll system to make it easier for small businesses to automatically pay their employees faster and with greater confidence.

QuickBooks Auto Payroll

Designing a more flexible payroll system to make it easier for small businesses to automatically pay their employees faster and with greater confidence.

QuickBooks Payroll is a cloud-based payroll software that allows businesses to pay employees, file payroll taxes and manage employee benefits and HR in one place. The software saves time by automatically calculating, filing and paying federal and state payroll taxes. Auto Payroll is a feature within QuickBooks Payroll that allows customers to set up running payroll as an automated process so their employees can be receive their paychecks quickly, accurately and regularly.

Auto Payroll V1 launched on March 2020, supporting 25,000 companies. In the summer of 2020 I led the project to work on the next generation of Auto Payroll.

QuickBooks Payroll is a cloud-based payroll software that allows businesses to pay employees, file payroll taxes and manage employee benefits and HR in one place. The software saves time by automatically calculating, filing and paying federal and state payroll taxes. Auto Payroll is a feature within QuickBooks Payroll that allows customers to set up running payroll as an automated process so their employees can be receive their paychecks quickly, accurately and regularly.

Auto Payroll V1 launched on March 2020, supporting 25,000 companies. In the summer of 2020 I led the project to work on the next generation of Auto Payroll.

QuickBooks Payroll is a cloud-based payroll software that allows businesses to pay employees, file payroll taxes and manage employee benefits and HR in one place. The software saves time by automatically calculating, filing and paying federal and state payroll taxes. Auto Payroll is a feature within QuickBooks Payroll that allows customers to set up running payroll as an automated process so their employees can be receive their paychecks quickly, accurately and regularly.

Auto Payroll V1 launched on March 2020, supporting 25,000 companies. In the summer of 2020 I led the project to work on the next generation of Auto Payroll.

Discovery

Discovery

Discovery

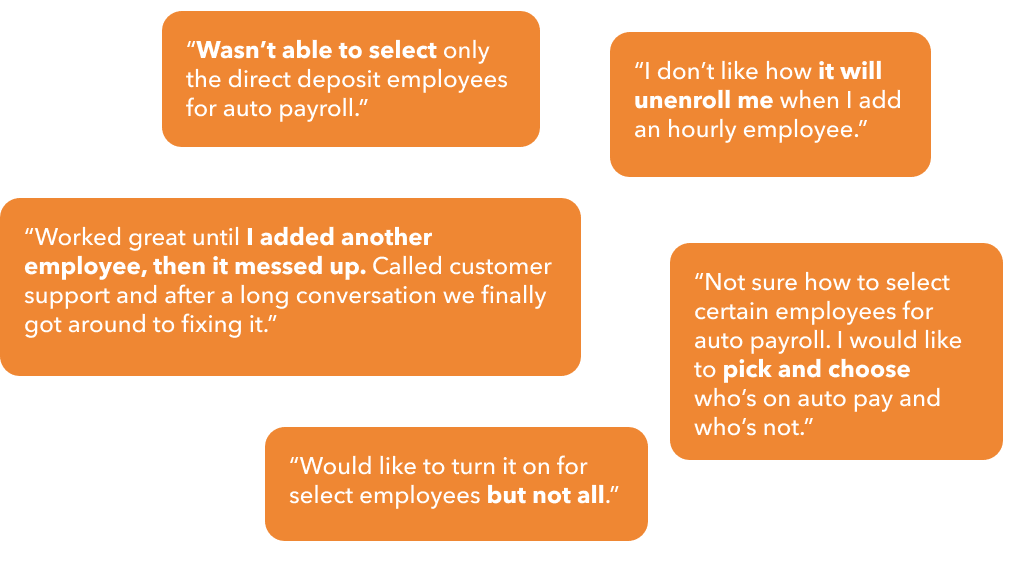

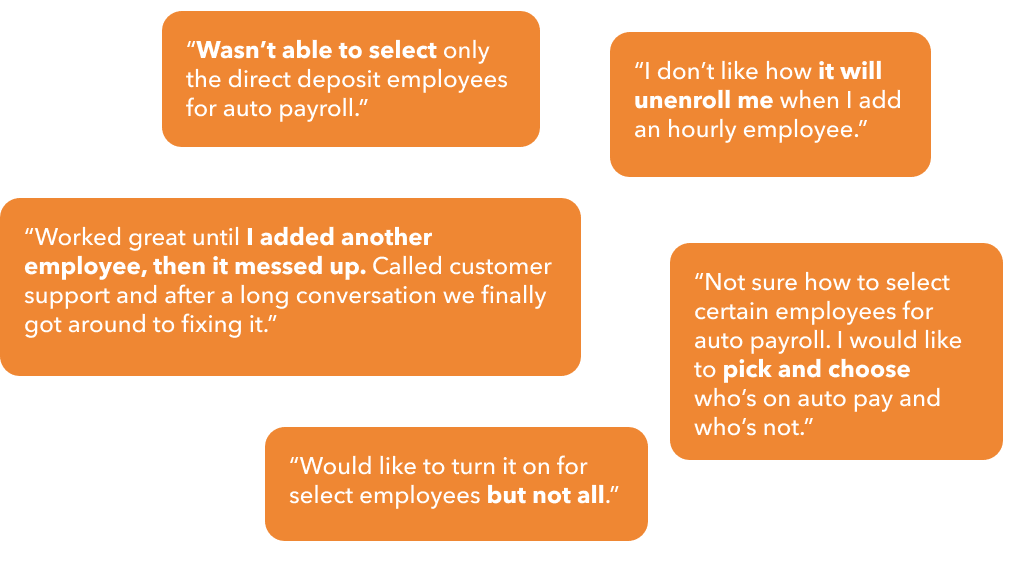

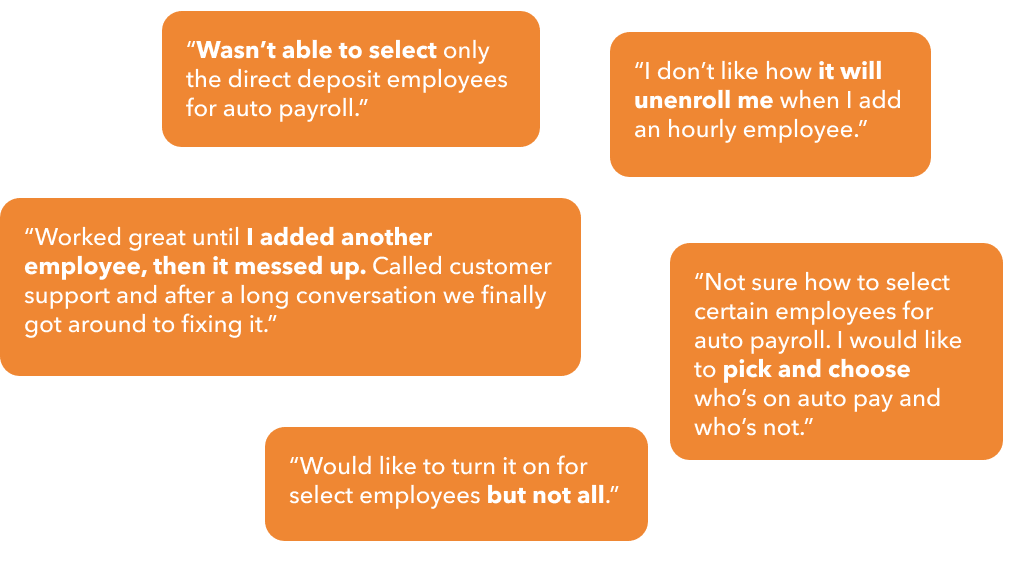

At the start of the project it was important for myself and the team to understand how well the current Auto Payroll feature was working for our customers and what could be improved in the next version. I led in-depth studies of the current experience, gathering qualitative and quantitive feedback. I conducted interviews with current QuickBooks Payroll customers who were actively using Auto Payroll to pay their employees. With deep empathy, I captured what customers enjoyed, as well as their frustrations and friction points in the experience.

At the start of the project it was important for myself and the team to understand how well the current Auto Payroll feature was working for our customers and what could be improved in the next version. I led in-depth studies of the current experience, gathering qualitative and quantitive feedback. I conducted interviews with current QuickBooks Payroll customers who were actively using Auto Payroll to pay their employees. With deep empathy, I captured what customers enjoyed, as well as their frustrations and friction points in the experience.

At the start of the project it was important for myself and the team to understand how well the current Auto Payroll feature was working for our customers and what could be improved in the next version. I led in-depth studies of the current experience, gathering qualitative and quantitive feedback. I conducted interviews with current QuickBooks Payroll customers who were actively using Auto Payroll to pay their employees. With deep empathy, I captured what customers enjoyed, as well as their frustrations and friction points in the experience.

Worked great until I added another employee, then it messed up. Called customer support and after a long conversation we finally got around to fixing it.

Worked great until I added another employee, then it messed up. Called customer support and after a long conversation we finally got around to fixing it.

Worked great until I added another employee, then it messed up. Called customer support and after a long conversation we finally got around to fixing it.

Some key learnings:

A majority of customers had one or more employees who fell into types that were incompatible with Auto Payroll (hourly employees without default hours, commission only, pending setup, etc.)

Customers preferred to have only a subset of their employees on auto-pay for various reasons.

Making a change to a single employee profile would turn Auto Payroll off for all employees

Companies with more than one pay schedule could not be eligible for Auto-Payroll.

Some key learnings:

A majority of customers had one or more employees who fell into types that were incompatible with Auto Payroll (hourly employees without default hours, commission only, pending setup, etc.)

Customers preferred to have only a subset of their employees on auto-pay for various reasons.

Making a change to a single employee profile would turn Auto Payroll off for all employees

Companies with more than one pay schedule could not be eligible for Auto-Payroll.

Some key learnings:

A majority of customers had one or more employees who fell into types that were incompatible with Auto Payroll (hourly employees without default hours, commission only, pending setup, etc.)

Customers preferred to have only a subset of their employees on auto-pay for various reasons.

Making a change to a single employee profile would turn Auto Payroll off for all employees

Companies with more than one pay schedule could not be eligible for Auto-Payroll.

Over the course of discovery, our team learned that the while the first version of Auto Payroll was useful, it could also be very rigid in its requirements that a company would need to meet to be eligible for Auto Payroll. Simple changes like adding an additional pay schedule or adding a new employee often caused Auto Payroll to turn off, which would result in additional work for the customer to either fix, or force customers to pay their employees manually, which is what Auto Payroll was to supposed to alleviate.

Over the course of discovery, our team learned that the while the first version of Auto Payroll was useful, it could also be very rigid in its requirements that a company would need to meet to be eligible for Auto Payroll. Simple changes like adding an additional pay schedule or adding a new employee often caused Auto Payroll to turn off, which would result in additional work for the customer to either fix, or force customers to pay their employees manually, which is what Auto Payroll was to supposed to alleviate.

Over the course of discovery, our team learned that the while the first version of Auto Payroll was useful, it could also be very rigid in its requirements that a company would need to meet to be eligible for Auto Payroll. Simple changes like adding an additional pay schedule or adding a new employee often caused Auto Payroll to turn off, which would result in additional work for the customer to either fix, or force customers to pay their employees manually, which is what Auto Payroll was to supposed to alleviate.

Transformation

Transformation

Transformation

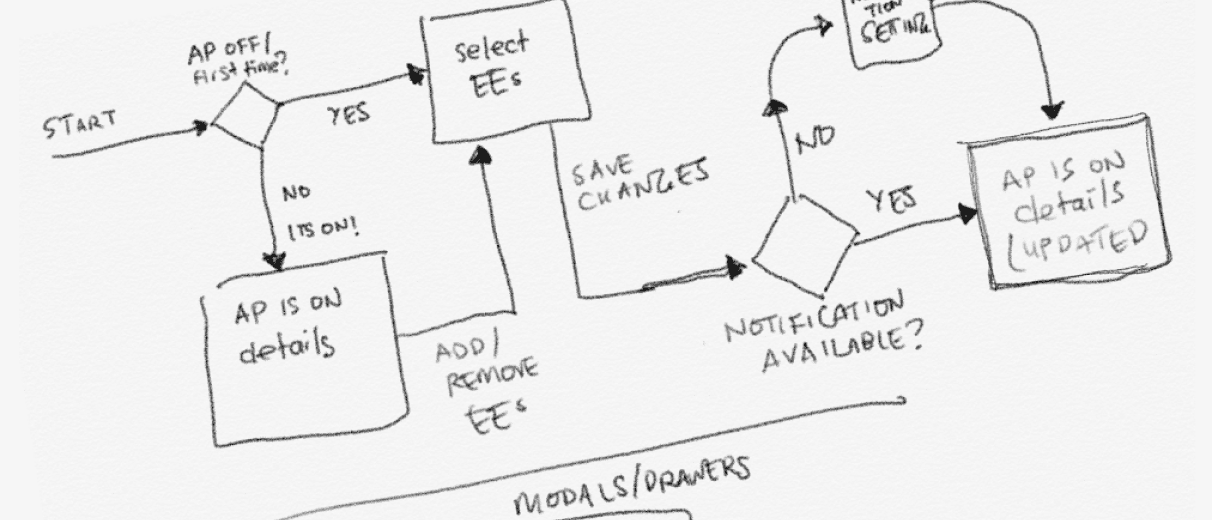

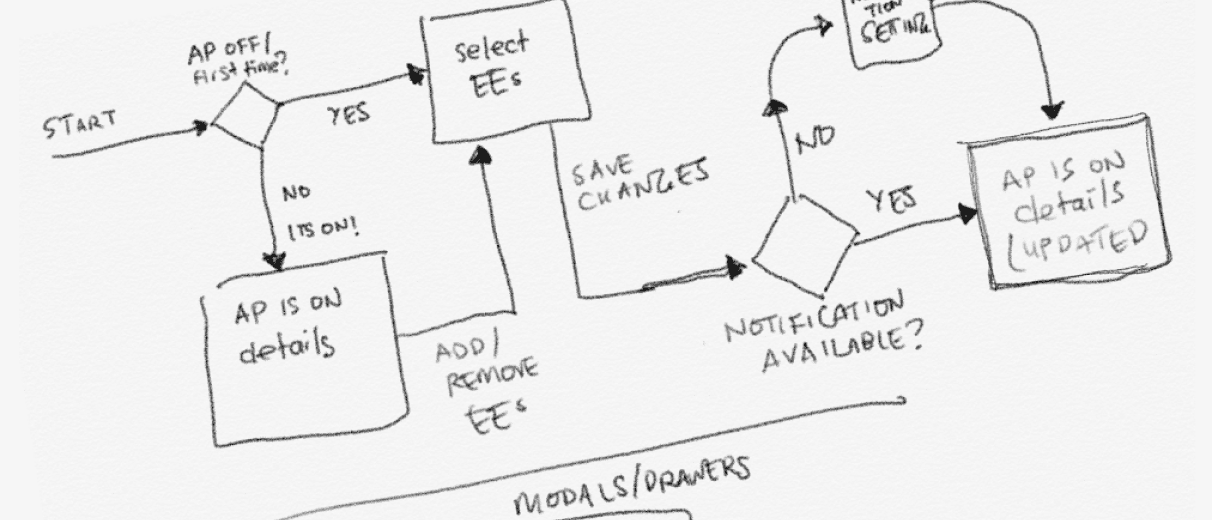

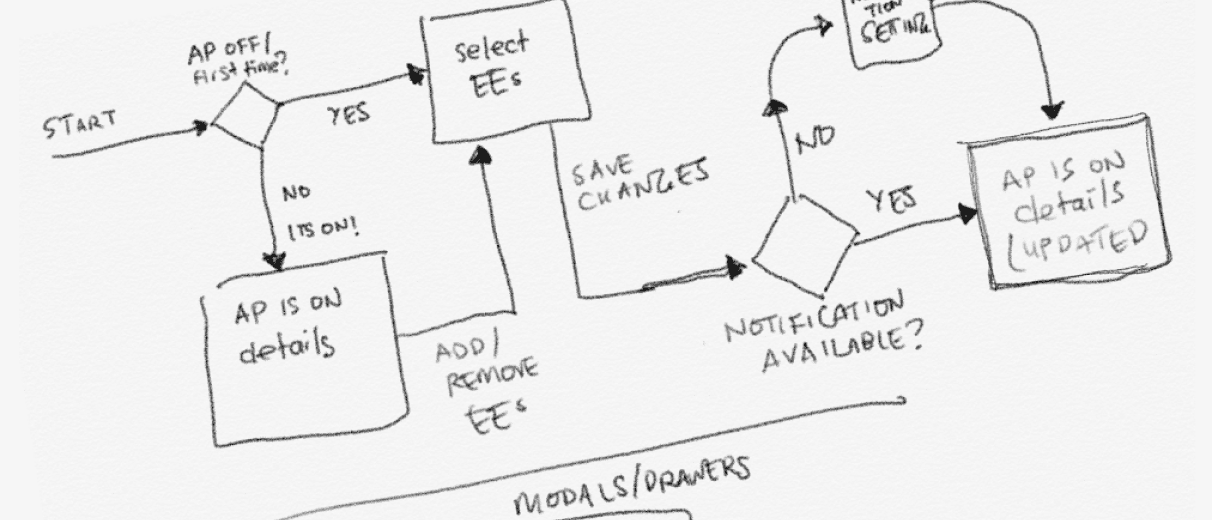

To address these key learnings, we looked at the current process and asked how we could make the setup process easier, with an auto payroll capability that allowed for more flexibility in terms of employees, employee types, and pay schedules.

To address these key learnings, we looked at the current process and asked how we could make the setup process easier, with an auto payroll capability that allowed for more flexibility in terms of employees, employee types, and pay schedules.

To address these key learnings, we looked at the current process and asked how we could make the setup process easier, with an auto payroll capability that allowed for more flexibility in terms of employees, employee types, and pay schedules.

We approached the redesign of Auto Payroll version 2 with the following experience principles in mind:

Flexibility: Allow a mix of some employees to be paid automatically rather than require all

Transparency: Always let customers know when Auto Payroll will happen

Notification: Give customers piece of mind and remind them to run payroll manually for non-AP employees

We approached the redesign of Auto Payroll version 2 with the following experience principles in mind:

Flexibility: Allow a mix of some employees to be paid automatically rather than require all

Transparency: Always let customers know when Auto Payroll will happen

Notification: Give customers piece of mind and remind them to run payroll manually for non-AP employees

We approached the redesign of Auto Payroll version 2 with the following experience principles in mind:

Flexibility: Allow a mix of some employees to be paid automatically rather than require all

Transparency: Always let customers know when Auto Payroll will happen

Notification: Give customers piece of mind and remind them to run payroll manually for non-AP employees

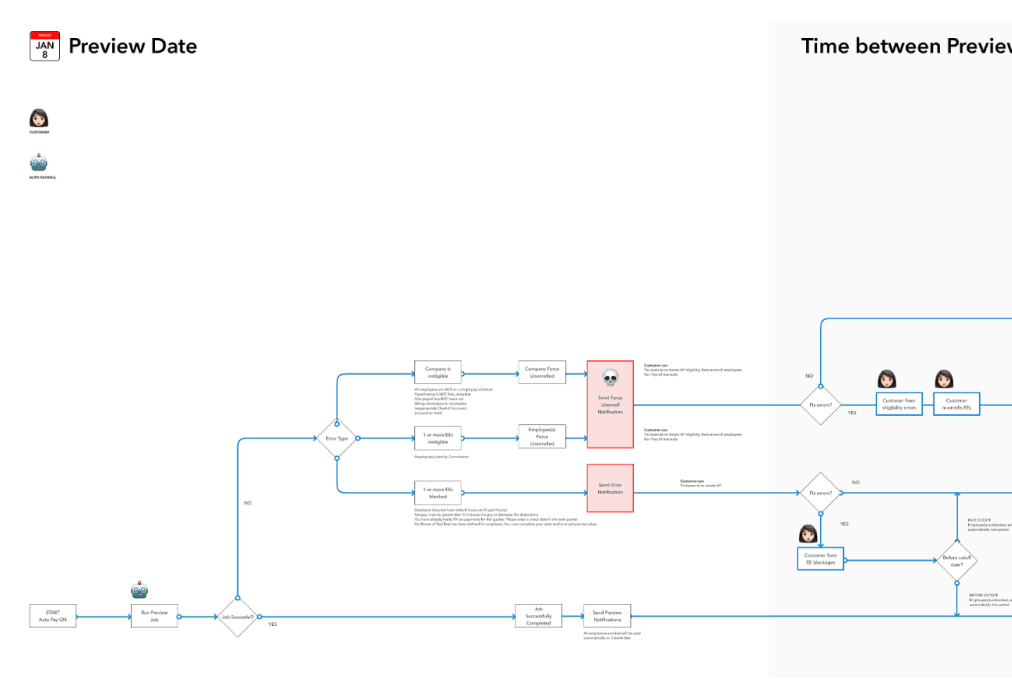

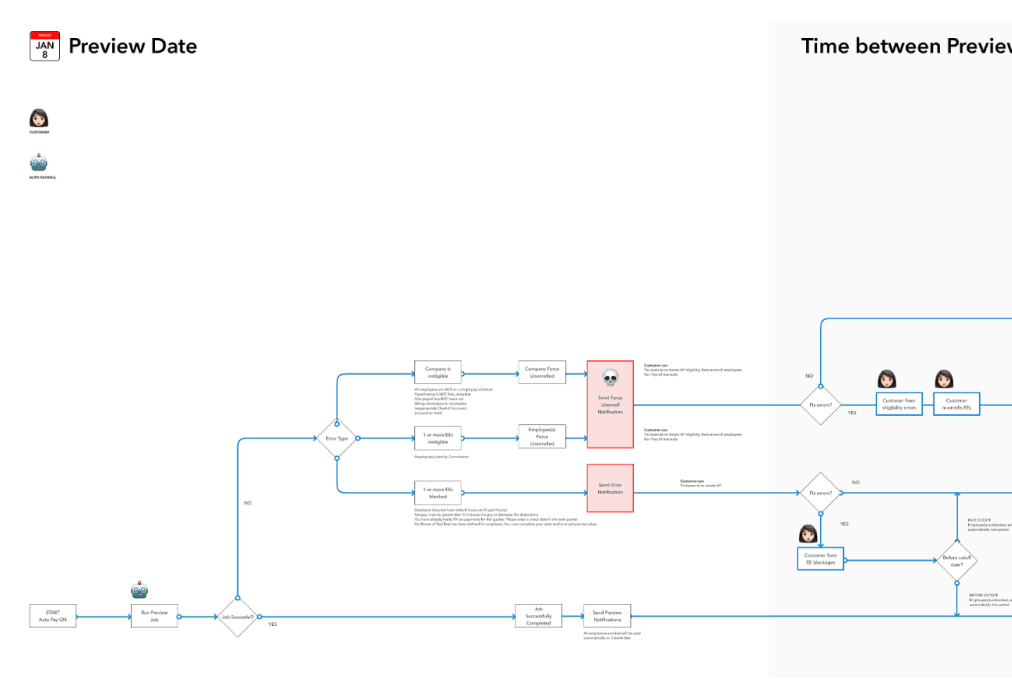

The factor of time was a significant consideration in looking at the design. Depending on how close or how far away payday was could change messaging or status of payroll. For example, when setting up auto payroll, if pay day was about to occur, changes could not apply until the next pay period, which meant automatic payments may not happen for a given employee for several weeks. In that case, the interface and notifications needed to make it clear to the customer of this and manual steps needed to make sure the affected employee is paid correctly and without interruption.

The factor of time was a significant consideration in looking at the design. Depending on how close or how far away payday was could change messaging or status of payroll. For example, when setting up auto payroll, if pay day was about to occur, changes could not apply until the next pay period, which meant automatic payments may not happen for a given employee for several weeks. In that case, the interface and notifications needed to make it clear to the customer of this and manual steps needed to make sure the affected employee is paid correctly and without interruption.

The factor of time was a significant consideration in looking at the design. Depending on how close or how far away payday was could change messaging or status of payroll. For example, when setting up auto payroll, if pay day was about to occur, changes could not apply until the next pay period, which meant automatic payments may not happen for a given employee for several weeks. In that case, the interface and notifications needed to make it clear to the customer of this and manual steps needed to make sure the affected employee is paid correctly and without interruption.

Details

Details

Details

Here is a summary of changes that rolled out with version 2 of QuickBooks Auto Payroll:

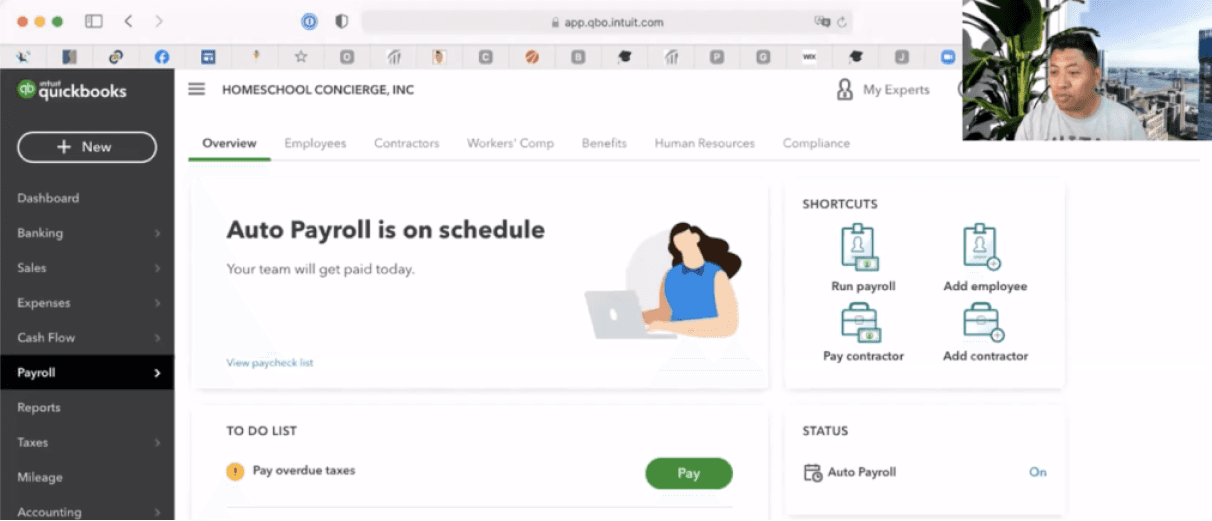

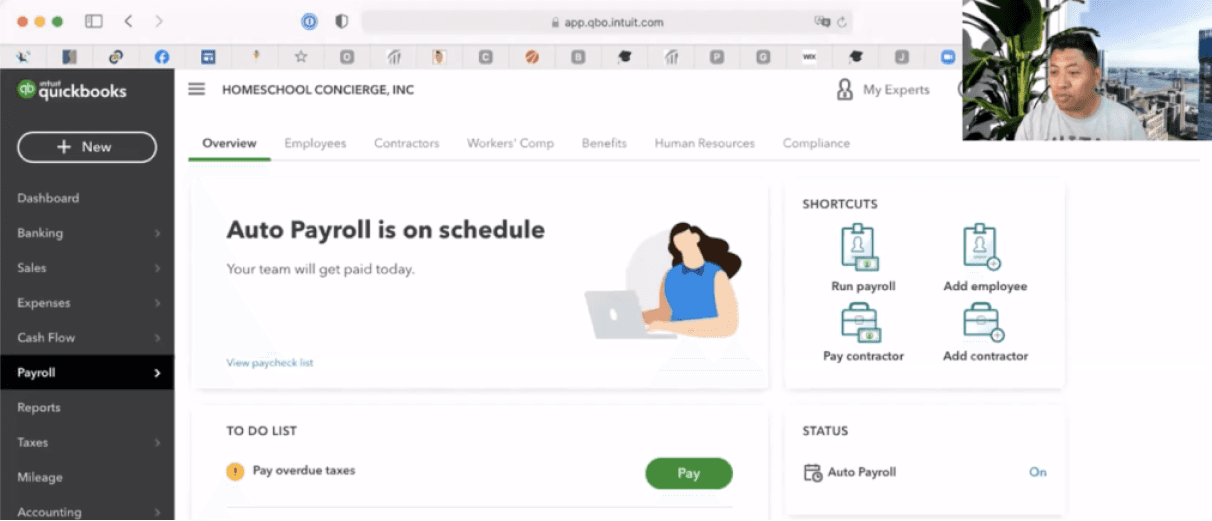

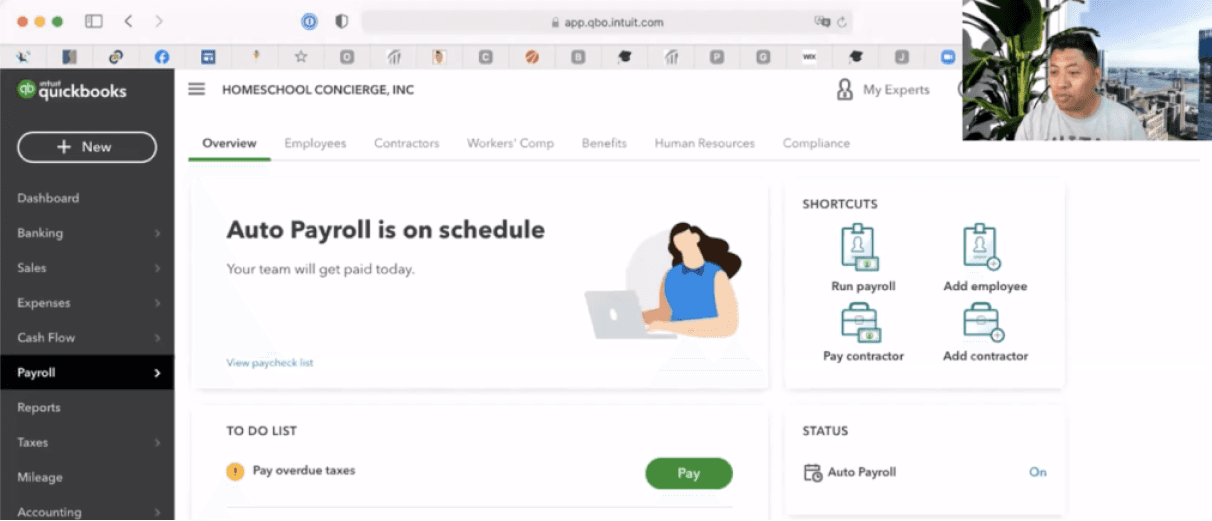

QuickBooks Payroll Dashboard

On the Payroll Home Page, prominent messages related to running payroll made it clear if Auto Payroll was active and when to expect payments sent to employees.

Here is a summary of changes that rolled out with version 2 of QuickBooks Auto Payroll:

QuickBooks Payroll Dashboard

On the Payroll Home Page, prominent messages related to running payroll made it clear if Auto Payroll was active and when to expect payments sent to employees.

Here is a summary of changes that rolled out with version 2 of QuickBooks Auto Payroll:

QuickBooks Payroll Dashboard

On the Payroll Home Page, prominent messages related to running payroll made it clear if Auto Payroll was active and when to expect payments sent to employees.

Run Payroll Detail View

The Detail View provides a birds-eye view of all employees who are going to be paid for the current pay period.

Employee table shows complete list of employees and who is paid automatically

If Auto Payroll is on, a page-level alert appears

Employees can easily switch from automatic to manual payroll for a given pay period

Auto payroll employees who are blocked are moved to the manual run payroll list

Run Payroll Detail View

The Detail View provides a birds-eye view of all employees who are going to be paid for the current pay period.

Employee table shows complete list of employees and who is paid automatically

If Auto Payroll is on, a page-level alert appears

Employees can easily switch from automatic to manual payroll for a given pay period

Auto payroll employees who are blocked are moved to the manual run payroll list

Run Payroll Detail View

The Detail View provides a birds-eye view of all employees who are going to be paid for the current pay period.

Employee table shows complete list of employees and who is paid automatically

If Auto Payroll is on, a page-level alert appears

Employees can easily switch from automatic to manual payroll for a given pay period

Auto payroll employees who are blocked are moved to the manual run payroll list

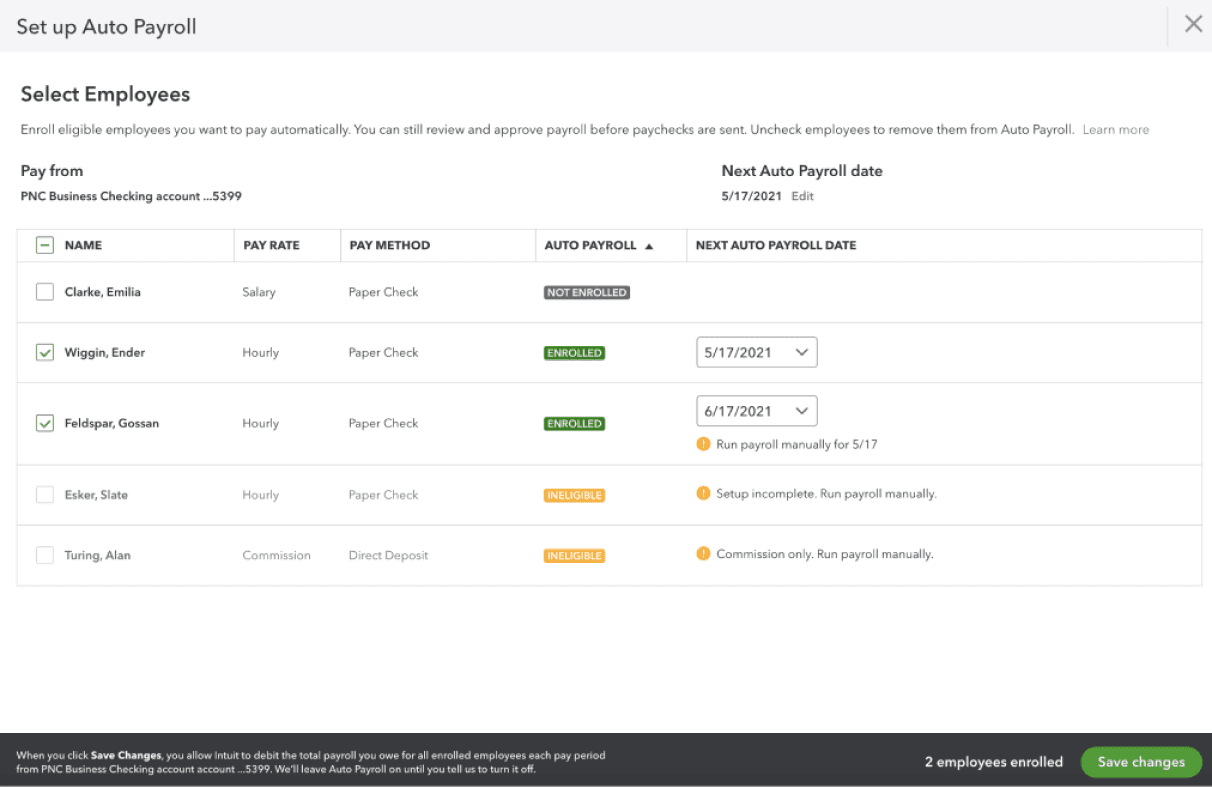

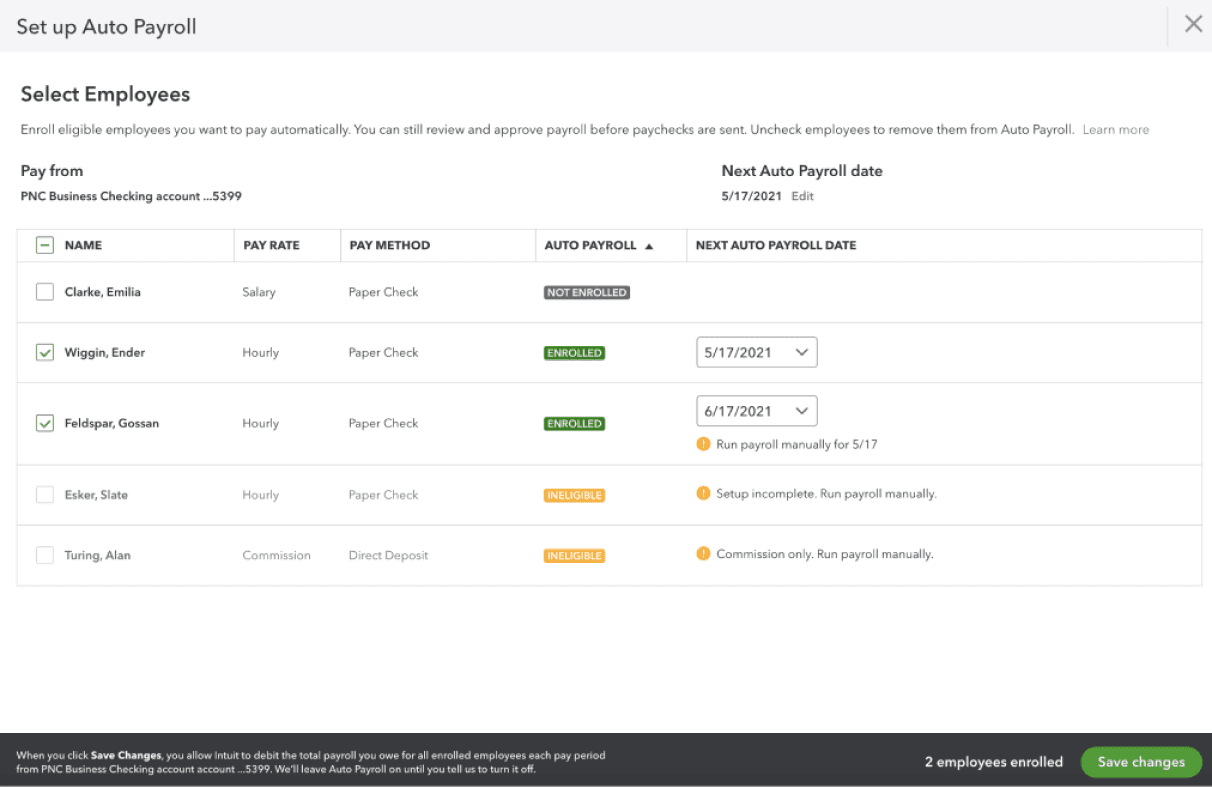

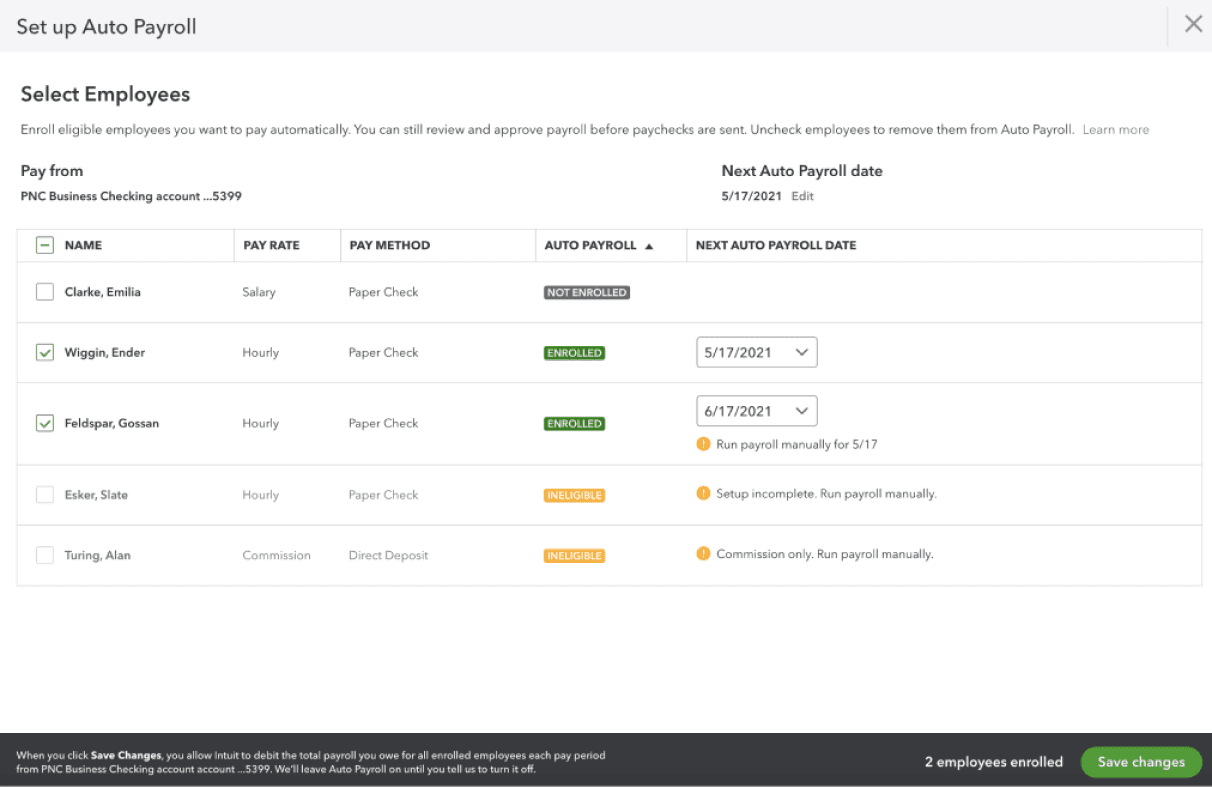

New Auto Payroll Setup View

Before, Auto Payroll was combined with the overview screen, which led to confusion. The new setup screen allows for easy selection and makes it clear who is - or is not - eligible for auto payroll.

Checkboxes allow easy toggle of automatic payment for all elgible employees

Status highlights when employees will be paid, as well as any blockers to payment or eligibility so customers know what they can do make an employee eligible

New Auto Payroll Setup View

Before, Auto Payroll was combined with the overview screen, which led to confusion. The new setup screen allows for easy selection and makes it clear who is - or is not - eligible for auto payroll.

Checkboxes allow easy toggle of automatic payment for all elgible employees

Status highlights when employees will be paid, as well as any blockers to payment or eligibility so customers know what they can do make an employee eligible

New Auto Payroll Setup View

Before, Auto Payroll was combined with the overview screen, which led to confusion. The new setup screen allows for easy selection and makes it clear who is - or is not - eligible for auto payroll.

Checkboxes allow easy toggle of automatic payment for all elgible employees

Status highlights when employees will be paid, as well as any blockers to payment or eligibility so customers know what they can do make an employee eligible

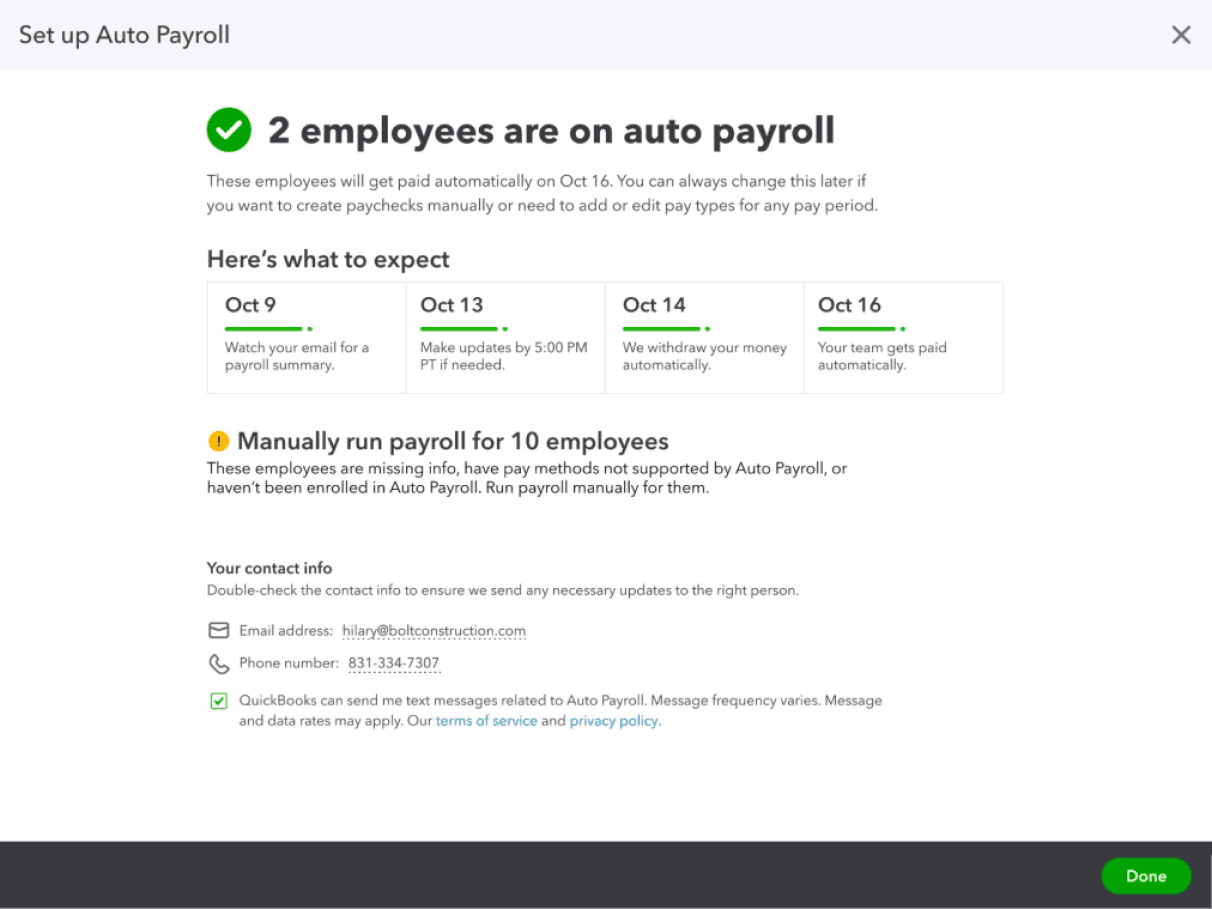

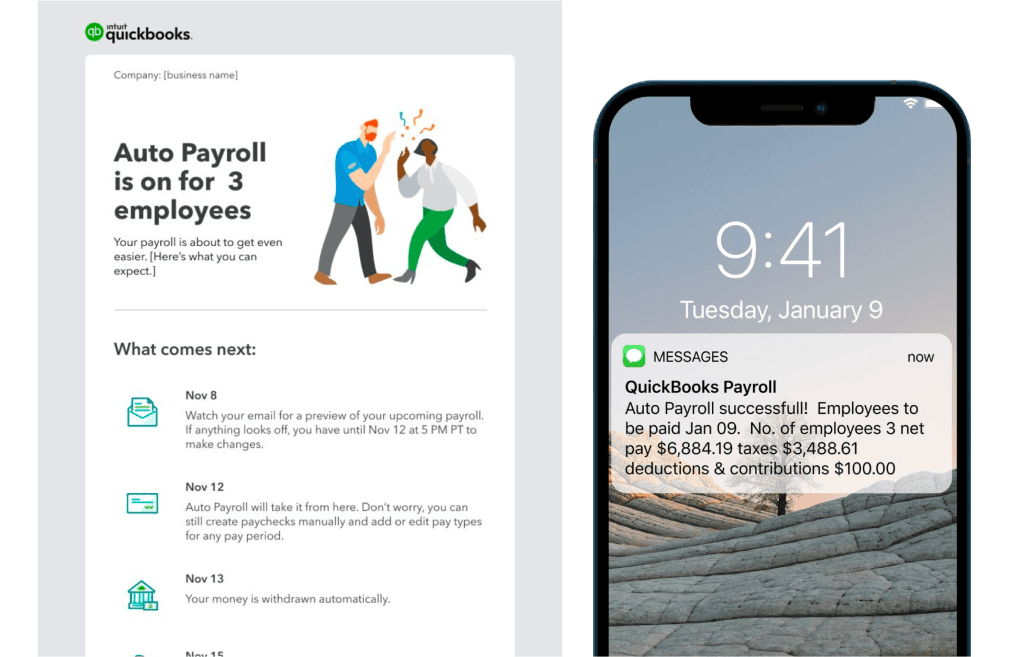

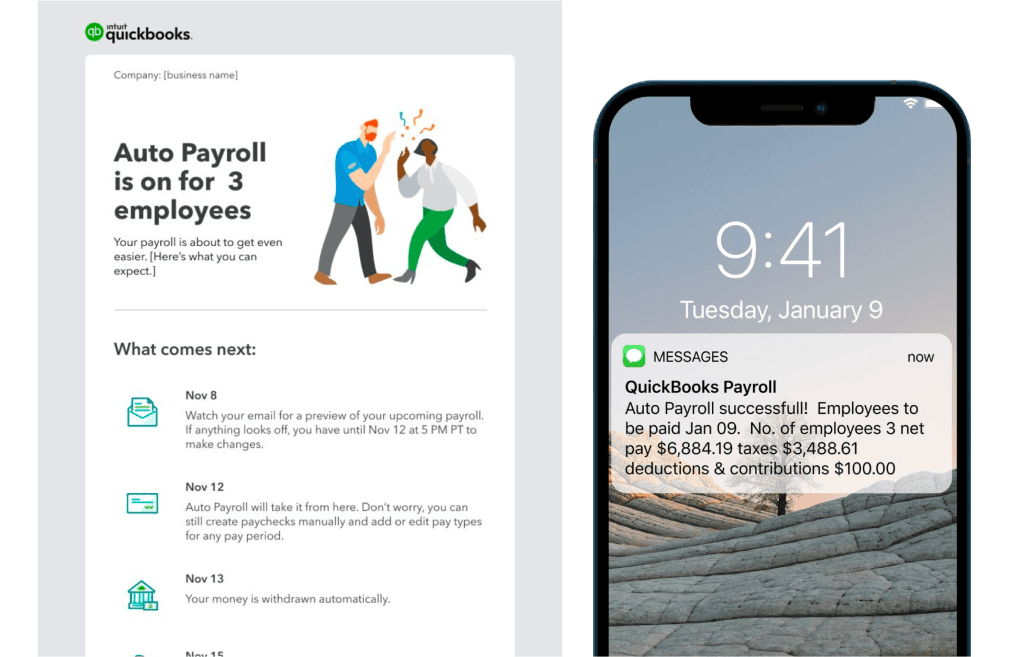

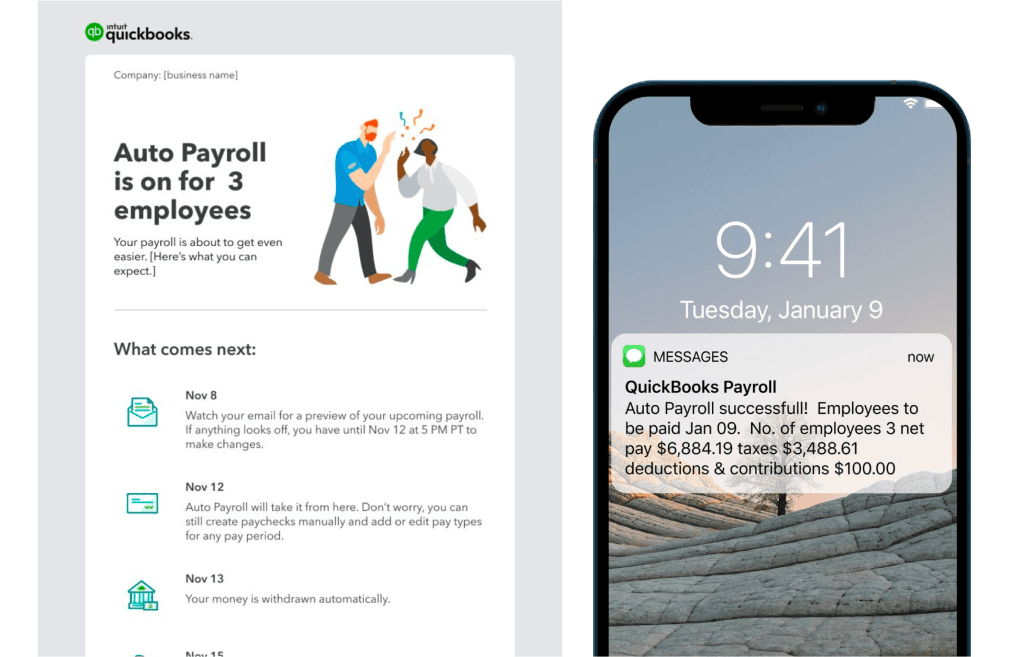

Auto Payroll Setup Confirmation

When setup is complete, or changes have been made to Auto Payroll, the confirmation screen will let the customer know what changes were made and how the scheduled payment will roll out. Other key features included:

Prominent display showing how many employees to be paid automatically

A list of key dates to set customer expectations on when automatic payments will happen

Strong reminder on the need to process payroll manually if there were other employees not on Auto Payroll

Options for notifications by Email and SMS Text

Auto Payroll Setup Confirmation

When setup is complete, or changes have been made to Auto Payroll, the confirmation screen will let the customer know what changes were made and how the scheduled payment will roll out. Other key features included:

Prominent display showing how many employees to be paid automatically

A list of key dates to set customer expectations on when automatic payments will happen

Strong reminder on the need to process payroll manually if there were other employees not on Auto Payroll

Options for notifications by Email and SMS Text

Auto Payroll Setup Confirmation

When setup is complete, or changes have been made to Auto Payroll, the confirmation screen will let the customer know what changes were made and how the scheduled payment will roll out. Other key features included:

Prominent display showing how many employees to be paid automatically

A list of key dates to set customer expectations on when automatic payments will happen

Strong reminder on the need to process payroll manually if there were other employees not on Auto Payroll

Options for notifications by Email and SMS Text

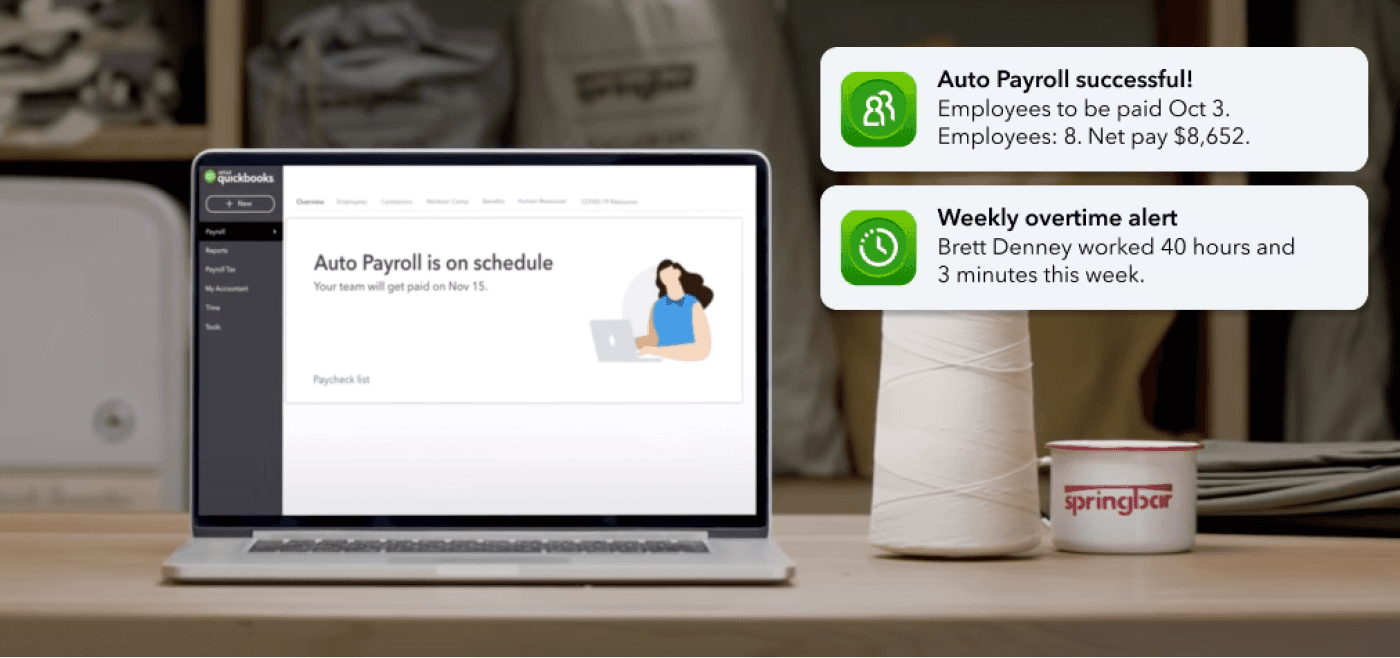

Robust Notification System

Timely and useful notifications by email and/or text let customers know when Auto Payroll is scheduled and when payment is successful. When there are errors or anomalies, notifications will help the customer know so that they can make changes or updates to ensure employees are paid without interruption.

Robust Notification System

Timely and useful notifications by email and/or text let customers know when Auto Payroll is scheduled and when payment is successful. When there are errors or anomalies, notifications will help the customer know so that they can make changes or updates to ensure employees are paid without interruption.

Robust Notification System

Timely and useful notifications by email and/or text let customers know when Auto Payroll is scheduled and when payment is successful. When there are errors or anomalies, notifications will help the customer know so that they can make changes or updates to ensure employees are paid without interruption.

Conclusion

Processing payroll used to take around an hour and a half to 2 hours. Now, it’s about 20 minutes.

Processing payroll used to take around an hour and a half to 2 hours. Now, it’s about 20 minutes.

Processing payroll used to take around an hour and a half to 2 hours. Now, it’s about 20 minutes.

Auto Payroll version 2 launched in early 2021 with an improved setup and selection process. In addition to improving usability, by making Auto Payroll work with multiple pay schedules, we increased eligibility from 50% to 70% of the customer base. This also provided more users with the flexibility and control over their payroll processes, so they can get time back to focus on what matters the most in their businesses, while having the confidence that their employees will get paid correctly.

Auto Payroll version 2 launched in early 2021 with an improved setup and selection process. In addition to improving usability, by making Auto Payroll work with multiple pay schedules, we increased eligibility from 50% to 70% of the customer base. This also provided more users with the flexibility and control over their payroll processes, so they can get time back to focus on what matters the most in their businesses, while having the confidence that their employees will get paid correctly.

Auto Payroll version 2 launched in early 2021 with an improved setup and selection process. In addition to improving usability, by making Auto Payroll work with multiple pay schedules, we increased eligibility from 50% to 70% of the customer base. This also provided more users with the flexibility and control over their payroll processes, so they can get time back to focus on what matters the most in their businesses, while having the confidence that their employees will get paid correctly.