When QuickBooks' AI is unable to categorize a transaction, it will ask the customer questions in the form of this UI.

Current transaction management tools make it hard for bookkeepers to gather information from customers, and customers often take a while to respond to bookkeeper’s questions.

When ambiguous transactions appear in the record, the bookkeeper needs to request additional contextual information from the customer, such as who the payee was, or what the reason was for the transaction. The answers provided by the customer are then reviewed by the bookkeeper, and the transaction is then categorized into the customers' books. This process can be tedious and time-consuming, diverting the bookkeeper from working on more important bookkeeping tasks.

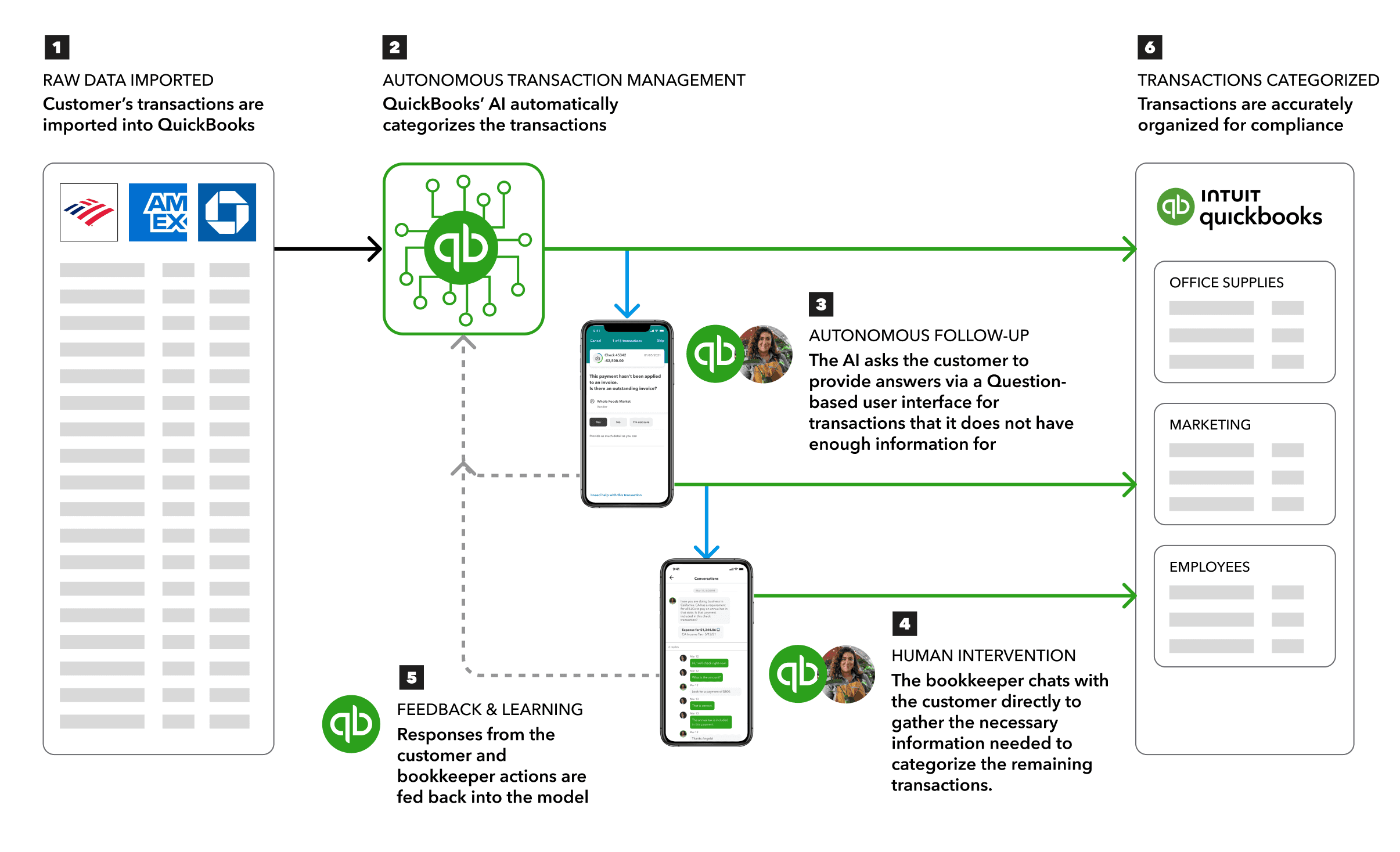

A simplified diagram explaining how AI is integrated into the QuickBooks Live accounting process, resulting in reduced customer service time by 35%.

We integrated QuickBooks’s AI model into our bookkeepers' process to do a majority of the transaction management work upfront.

Intuit delivers the industry’s best categorization system for financial transactions with 2 million personalized models refreshed daily in QuickBooks. Serving millions of customers with one-to-one mapping between the model and the customer's data, each model is tailored to a small business customer's unique situation. The model "learns" from user preferences for categorizing transactions.

Working closely with QuickBook's AI team, I developed a process for how the AI would work with our virtual bookkeepers to reduce their transaction management workload.

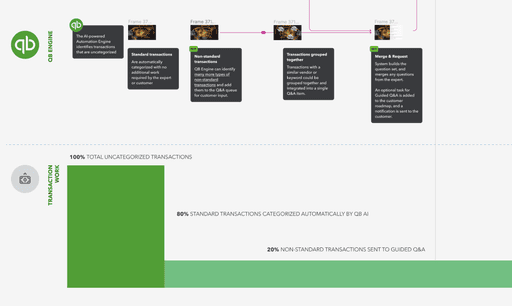

Detour! The AI capability was limited to categorizing up to 80% of customers transactions.

On average, the remaining 20% of transactions did not have enough context for the AI to make an accurate categorization. In these cases the bookkeepers would also need to ask customers questions, so we allowed bookkeepers to insert questions into the Q&A user interface, or ask directly via chat method.

Last-mile management: when QuickBooks' AI has reached its limits in gathering information to take action on a transaction, the customer's bookkeeper can gather information directly via chat.

The resulting designs outlined a new accounting and customer service process that integrates Intuit's AI to automaticaly categorize transactions and ask questions about ambiguous transactions.

By offloading the most tedious work of categorizing transactions, the amount of time a QuickBooks Live bookkeeper spent on managing transactions is reduced from over 10 hours per customer to under 4 hours per customer. As a result, the bookkeeper still has to gather additional information for ambiguous low-context transactions, but the experience is easier for both the bookkeeper and the customer. Also, the categoraization process is much faster, which leads to the customer gets to benefit sooner, which leads to higher satisfaction with the virtual service.